Contents

With forward testing, you simulate actual trading and test your strategy on a live market. If you are interested in doing backtesting manually, Excel is the way to go. This popular Microsoft software that has been used in various fields has found its way to the Forex industry.

You can use software to simulate years of trading data in just hours and massively fast track your trading experience. We have compiled a list of the worlds leading Forex Backtesting Software Providers. With what does backtesting mean in Forex, backtesting put simply is your method at work with previous market information. Effective traders do this to see how trusted their technique is, and how successful it is and how it acts in various market conditions. With what does backtesting mean in Forex, trader’s likewise have the capability to trade safe with a demonstration trading account. This implies that traders can prevent putting their capital at threat, and they can select when they want to transfer to the live markets.

Importance of Backtesting in Forex

The tools offered by the trading platform have proved to be successful and secure. The assumption behind backtesting is that what worked in the past can also work well in the future. This means that if a strategy is profitable based on past market conditions, there’s a chance that it will be effective when applied to current market data. By fitting the curve, or over optimizing, you can produce a system that has been back tested and looks very good over a specific historical period. You can use a forex simulator to test the data on your own, or you can use forex backtesting software that allows you to test basic to more sophisticated concepts.

Make sure you stick to a game plan and have benchmarks that describe your goals. Amanda Jackson has expertise in personal finance, investing, and social services. She is a library professional, transcriptionist, editor, and fact-checker.

Algorithms are sets of rules for solving problems or accomplishing tasks. Scenario analysis is commonly used to estimate changes to a portfolio’s value in response to an unfavorable event and may be used to examine a theoretical worst-case scenario. By the time you with the inside information in this detailed guide you’ll know exactly why does MT4 say no connection, how to troubleshoot the issue in a hurry, and how to get yourself back up and… Once in options, click on Charts and set the max bars in history to 500,000.

FXCM Policies

A portfolio with beta 1 means the portfolio has the same volatility as the market. Beta is used to capture the relationship between portfolio volatility with respect to market volatility. It tells if the market is moved by x percentage how much a portfolio is expected to increase or decrease.

It offers the most flexibility for managing memory and optimising execution speed but can lead to subtle bugs and is difficult to learn. There are various factors that you can look at to decide which market or assets will be best for the kind of trading you are looking to conduct. This hypothsesis states that securities that have positive returns over the past one year are likely to give positive returns over the next one month. Trading FX or CFDs on leverage is high risk and your losses could exceed deposits. Both winning and losing streaks happen quite often, and while nobody complains about extended winning streaks, most people become worried when they run into a few losses in a row.

- MATLAB – MATLAB is another programming language with multiple numerical libraries for scientific computation.

- The fourth and final step is to repeat everything again until you find another possible setup, which you will write down again.

- Created by the same software company that developed MT4, MetaTrader 5 is among the most used Forex trading platforms around the world.

- It has its own interface, but it relies on MetaTrader for key functionalities such as charting tools, sound effects, and other design elements.

- There’s more to a trading strategy than just the win rate and return.

Bad data points can generate faulty results if the data has inaccurate highs or lows which are used to generate entry or exit points. A test is when a stock’s price approaches an established support or resistance level set by the market. Look-ahead https://1investing.in/ bias occurs when information or data is used in a study or simulation that would not have been known or available during the period analyzed. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

This way, you will be able to see everything on the chart, which might help you to better understand the results. There are several testing modes offered by the platform and you can set them according to your preferences. The platform also offers traders visual testing, which makes it possible for traders to track the operations on the historical data. MetaTrader 4 is one of the best-known Forex trading platforms around the world which offers traders numerous capabilities.

Choosing the programming language for backtesting

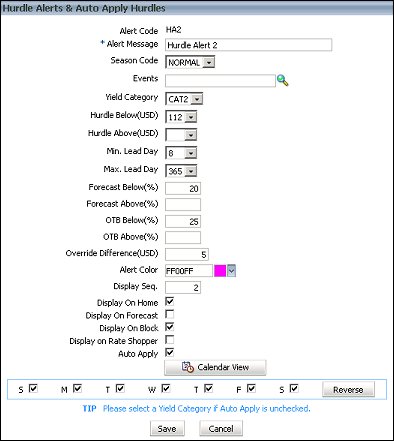

The next step is to select the Expert Advisor or a trading strategy as a testable element. There are many developed EAs on the market or you can create one yourself as well. After choosing the Expert, then you should select the trading symbol which indicates a Forex pair. The next step is to select the relevant time frame for the backtesting and after that the model of backtesting.

When it comes to developing a trading style or system, backtesting plays a very important role. An amazing thing about it is that if implemented properly, it can be very helpful for traders and can help you optimize and improve your trading strategies. There are dozens of commercial trading systems that are available in the market.

This is called optimization, and although it is easy toover-optimize a strategy, it is a useful tool for strategy creation and analysis. You can create the automated backtesting program yourself, but this can be time-consuming, especially if you’re not a programmer. Another option is to use free already-made programs, but in most cases, the free programs don’t offer as many features as the premium versions. The paid versions can be expensive, especially if you are a newbie trader.

Detailed Insight On Backtesting Software For Forex

The same principle applies to trading, and backtesting helps you with it. If you’re getting started with forex, struggling to see results, or just wanting to improve yourself, you need backtesting. The less uncertainty you face, the more likely you are to retain your objectivity and avoid the emotional pitfalls of trading.

Trading in CFDs carry a high level of risk thus may not be appropriate for all investors. 3-Enter all the necessary parameters (e.g. symbol, period, model, and spread). Before installing the Simple Forex Trader software you have to ensure that it will work properly in MT4. Download the software and complete the installation process by following the prompts.

I have seen forex robots that look amazing in MT4 backtests but completely burn when forward testing because the MT4 backtesting conditions were limited to 90% modelling quality. Birts TDS can achieve 99% modelling quality which is not perfect, but is the best that the MT4 strategy tester can do. Make sure you stick to the trading strategy and plan you are backtesting. It is easy to say “I would not have taken that trade” when you know that you really would have.

Although hard to code, developers are able to make a huge amount of different EA’s with different perimeters so they’re often being sold for fairly cheap on various market places. For example, I recently purchased an EA from ForexKingsthat was around the $40 price point. If you’re manually backtesting, you’ll become a better trader and be able to spot setups forming ahead of time as you would have seen the same pattern thousands of times. During backtesting trading strategies, you often tend to backtest a strategy on the current stock universe rather than the historical stock universe.

You can even set the time frames that you are comfortable with and focus on the important things only. In addition, there are numerous additional tools and indicators available on MetaTrader 4 which can be additional help. Trading involves risk and can result in the loss of your investment. All information on this site is for informational purposes only and is not trading, investment, tax or health advice. The reader bears responsibility for his/her own investment research and decisions. Seek the advice of a qualified finance professional before making any investment and do your own research to understand all risks before investing or trading.

If in-sample and out-of-sample backtests yield similar results, then they are more likely to be proved valid. A seemingly insignificant oversight, such as assuming that the earning report being available one day prior, can lead to skewed results during the backtesting. You need to make sure you are not using data that will only be available in the future to avoid look-ahead bias. Look-ahead is sold at iesser market value than its face value bias is the use of information in the analysis before the time it would have actually occurred. Thus, there might be situations where you include future data that was not able in the time period being tested. Backtesting resultsThe annualised return of the strategy is 23.41, which means that over the period of backtesting, the strategy generates a return of around 23% each year.